Learn More¶

Explore FinFacts' powerful features for portfolio attribution, performance reporting, and Excel integration.

Why FinFacts?¶

- Privacy First

Your sensitive portfolio data never leaves your machine. Local processing ensures complete data privacy and regulatory compliance.

- Professional Grade

Modified Dietz returns, Brinson-Fachler attribution, and Carino/Menchero linking methods trusted by investment professionals.

- Branded Reports

Generate professional, one-page factsheets and comprehensive audit reports with your firm's branding.

Key Features¶

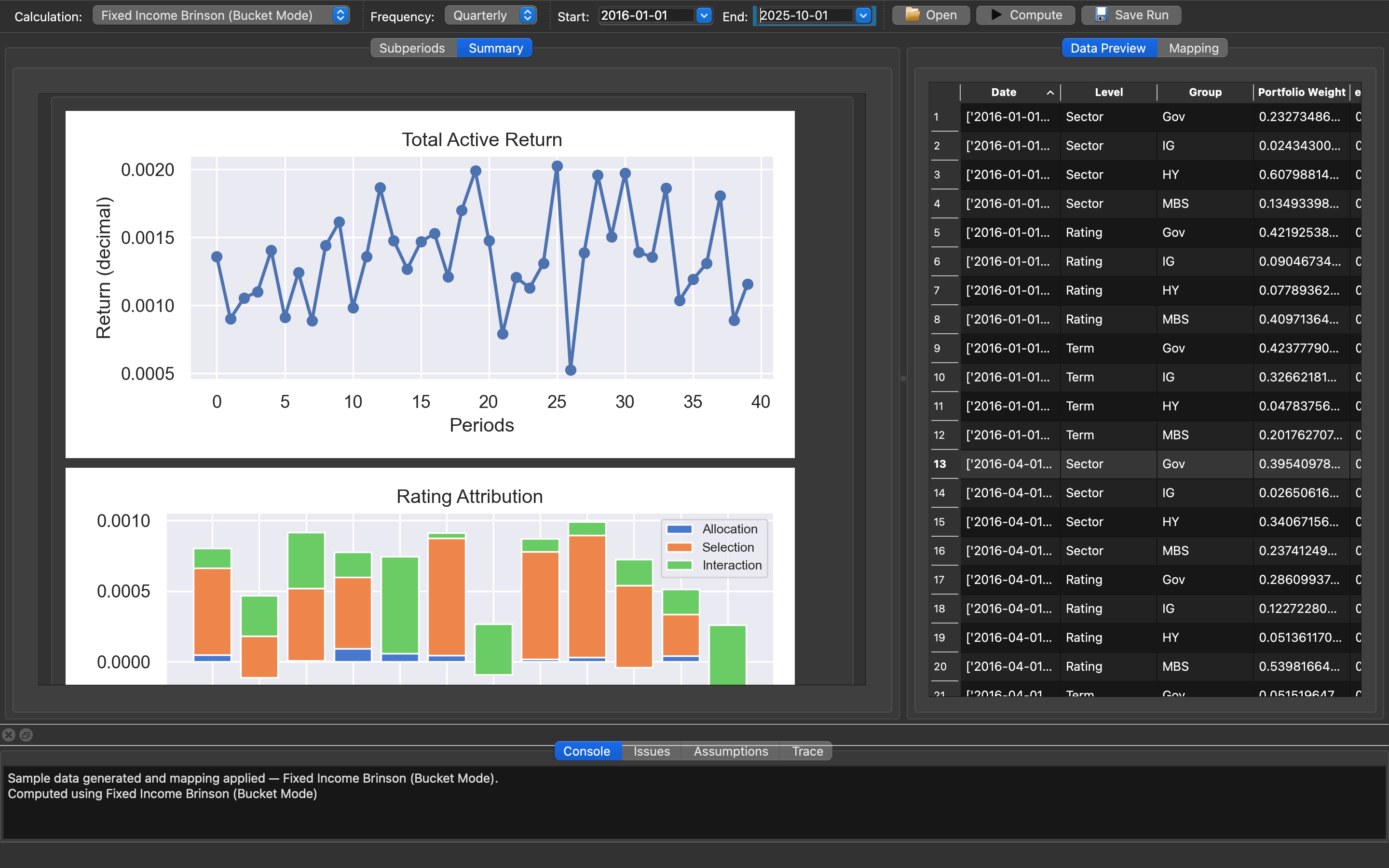

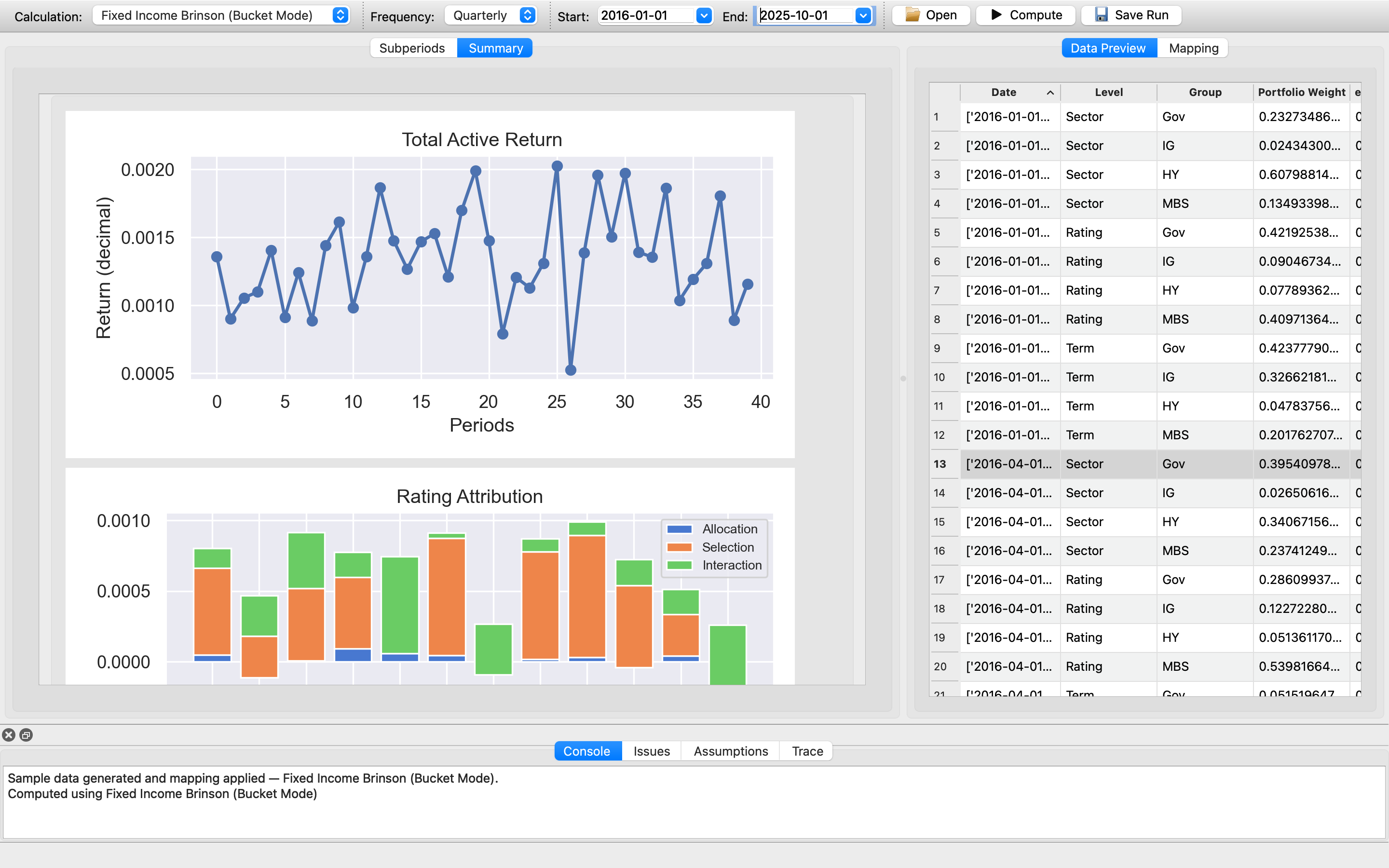

Portfolio Attribution¶

Comprehensive Brinson-Fachler attribution with asset allocation, security selection, and interaction effects. Multi-period linking with industry-standard methods.

Return Calculations¶

Modified Dietz and Time-Weighted Return (TWR) calculations with precise flow weighting and period handling.

Composite Management¶

Build and manage composites with membership tracking, rules-based inclusion, and audit trail maintenance.

Future Roadmap¶

- Excel Integration (Planned)

Native Excel ribbon integration for data validation, mapping configuration, and one-click report generation.

Trusted by Investment Professionals¶

"FinFacts solved our month-end reporting bottleneck. What used to take days now takes hours, with complete audit trails and reproducible results."

— Portfolio Manager, Mid-Market Asset Manager

Getting Started¶

- Download the latest version for Windows or macOS

- Install the Excel add-in for seamless integration

- Import your portfolio and benchmark data

- Generate professional factsheets in minutes

Technical Specifications¶

- Platforms: Windows 10/11, macOS 10.15+

- Excel Support: Excel 2016 or later (Windows/Mac)

- Data Formats: CSV, XLSX, Excel named tables

- Output Formats: PDF factsheets, CSV/XLSX reports

- Security: Local processing, HTTPS bridge, encrypted licensing